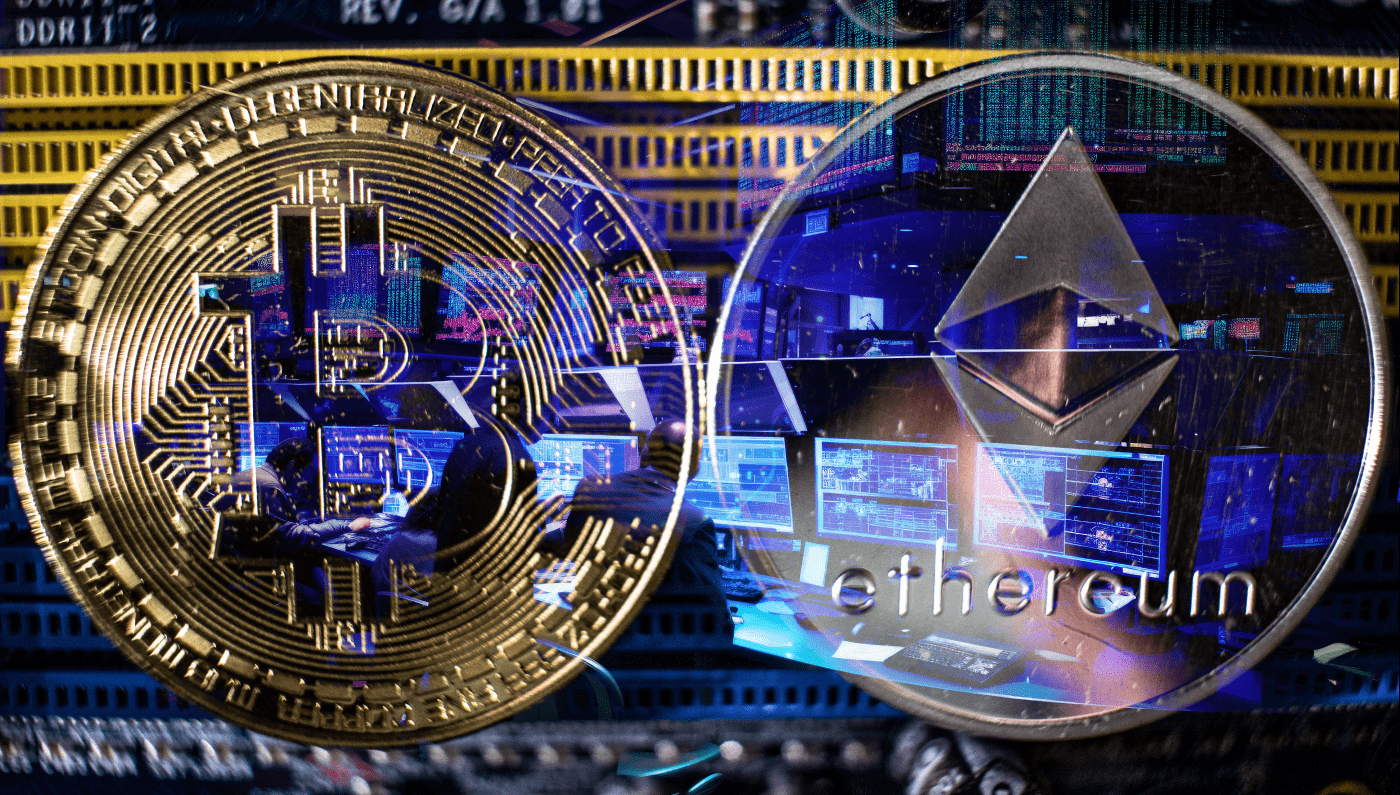

London Stock Exchange Looking to List Bitcoin and Ethereum ETNs in Late May

The London Stock Exchange (LSE) is gearing up to list cryptocurrency exchange-traded notes (ETNs) for Bitcoin (BTC) and Ethereum (ETH) by the end of May, marking a significant step towards crypto adoption in the traditional financial market. This move comes following a notable shift in stance by the Financial Conduct Authority (FCA) towards crypto assets.

Earlier this month, the LSE expressed its intent to accept proposals for physically backed bitcoin and ether ETNs, which are debt securities that would trade on the exchange during London trading hours. Now, the exchange has provided more clarity on the timeline for these listings.

Applications for bitcoin and ether ETNs are set to open on April 8, with a deadline for submissions by April 15 if issuers aim to have the securities listed by May 28. The LSE chose this date for the listing to allow for the maximum number of issuers to participate from the start of trading.

In order to be considered for listing, bitcoin and ether ETNs must have their assets “wholly or principally held in cold storage.” If such storage is unavailable, issuers must obtain third-party audit reports and secure regulated custodians to meet the LSE’s requirements.

This move by the London Stock Exchange is a significant milestone, given the previous stringent stance by the FCA. The FCA had previously banned the sale, marketing, and distribution of crypto ETNs to retail consumers in January 2021. However, in a reversal, the FCA now allows exchanges to list such ETNs, but they are restricted to professional investors.

While the ban on crypto ETNs remains for retail customers, the LSE’s decision to list these ETNs represents a major shift in the UK’s regulatory approach to cryptocurrencies. Oliver Linch, CEO of Bittrex Global, called the FCA’s move a “pretty big reversal,” indicating the changing landscape of crypto investment products.

The LSE’s announcement aligns with its previous notice on March 11, 2024, stating its acceptance of applications for admission to trading of Bitcoin and Ethereum Crypto ETNs in the second quarter of 2024. The exchange plans to launch the market for Bitcoin and Ethereum ETNs on May 28, pending approval of base prospectuses by the FCA.

Issuers proposing to establish a crypto ETN program and list securities on the Main Market on the launch date must submit a letter to the LSE by April 15, detailing how they meet the requirements outlined in the Crypto ETN factsheet. Additionally, they must provide a draft of the base prospectus for FCA approval by May 22.

The introduction of the Crypto ETN market on the LSE reflects the UK’s efforts to embrace crypto innovation and investment. With regulators showing a more favorable stance towards crypto assets, the UK aims to position itself as a global hub for cryptocurrency. The FCA’s decision to allow recognized investment exchanges to create a market segment for ETNs, though limited to professional investors, signals a growing acceptance of cryptocurrencies in the traditional financial landscape.

This news is brought to you by ai-stakes.com, an artificial intelligence application that automates crypto trading, allowing you to effortlessly generate profits.

Ready to revolutionize your trading experience? Click here to register and embark on your journey to financial empowerment with ai-stakes.com.