6 Reasons Why Bitcoin Is Here to Stay

If you’re considering diving in and buying Bitcoin, the question you will likely ask yourself is whether or not the coin is going to keep on its current trajectory or is riding the crest of a bubble. This is a serious concern since a burst bubble would mean significant losses.

In this post, we’ll explore how the first and largest cryptocurrency is unconventional in very specific ways that help shield it from the bubble risks faced by other financial assets.

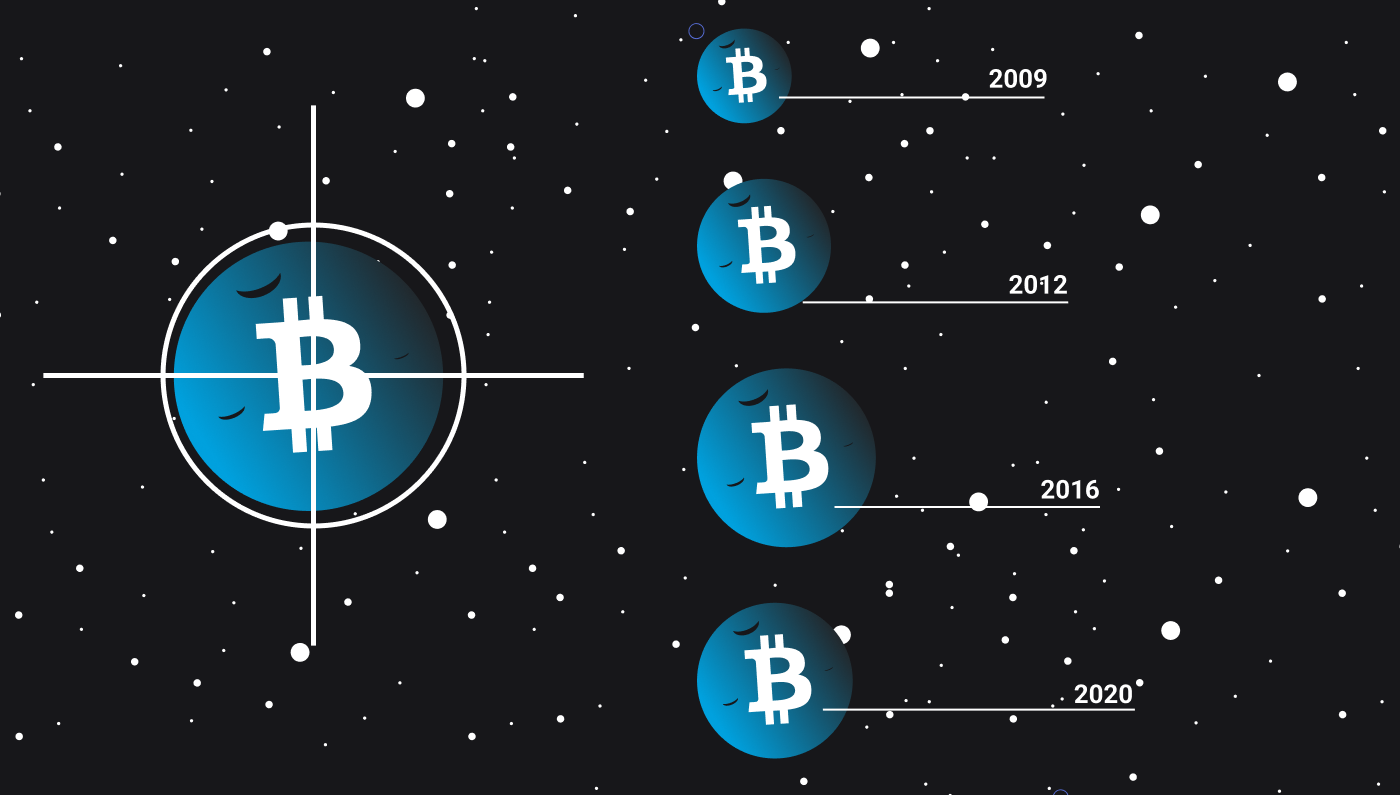

Bitcoin Has a History of Bouncing Back Higher

To understand Bitcoin’s incredible resilience, we need to view its historic trajectory, from its beginnings almost 15 years ago, in 2009, when it first entered the financial arena. Since its inception, it has weathered the storms of market volatility, emerging stronger every time. This is not to say there haven’t been dark times, with acute price crashes and long bearish spells, some of which lasted almost a year. Remarkably, after each of these episodes, Bitcoin not only regained its equilibrium but also soared to new heights.

Bitcoin’s price history is a real rollercoaster ride, evidenced by an almost 3,000% price surge in the summer of 2011, followed by a crash that same autumn, from around $30 to just $2. Then fast forward to 2013 for another leap in value to over $120. Today, just 10 years on, the price is around $25,000.

A Robust Regulatory Framework

Bitcoin enjoys an increasingly tough regulatory framework, globally, as well as within local jurisdictions.

Nations within Europe as well as the United Kingdom have implemented the FATF Travel Rule, aimed at combating money laundering and illicit activities related to virtual assets through the exchange of data among participating institutions.

Moreover, in the United States, Bitcoin is subject to state-level regulations imposed by local authorities and federal oversight by the SEC, CTFC, and FinCEN.

Now, Bitcoin is increasingly being viewed as a legitimate asset, and in the US cryptocurrencies are subject to taxation.

Ongoing Technological Developments

Bitcoin’s issues achieving scalability, security, and decentralization, in a single system have been a long-standing concern. But it has been making huge technological strides, with solutions like sharding, which makes validation far quicker while preserving Bitcoin’s decentralization. It involves the segmentation of data into smaller pieces, enabling the blockchain to process multiple, more manageable datasets simultaneously. Then, of course, there is the Lightning Network, which represents a second layer of the blockchain, creating channels between parties, enabling unlimited transactions to occur independently of the primary blockchain, and lessening the load on the main blockchain’s nodes.

Rapidly Rising Adoption

Bitcoin has come a long way towards mainstream adoption and recognition, with endorsements by corporations, investment firms, and major financial institutions, as well as by the US government, which holds hundreds of thousands of BTC.

Major corporations, like Microsoft, and PayPal, have incorporated Bitcoin into their financial strategies. These corporate endorsements are pivotal in broadening the acknowledgment of Bitcoin’s amazing utility.

Bitcoin continues to reign supreme as the most favored cryptocurrency, boasting a user base of 420 million individuals, and this number is growing by the day.

A Hedge in a Weak Global Economy

In the midst of formidable global economic challenges, like elevated inflation rates and lackluster growth, Bitcoin offers a hedge against financial uncertainty. Despite bouts of volatility, Bitcoin’s historical performance shows a consistent upward trajectory.

Bitcoin is replacing traditional stores of value like gold, bonds, or real estate, in large part due to its convenience and accessibility. It can be stored in a digital wallet, remaining accessible 24/7, from any location with an internet connection.

Bitcoin’s ability to navigate challenging market conditions is unmistakable, surviving not only the turbulence of the 2020 pandemic but also the 2022 FTX crash, a cataclysmic event for the crypto sphere.

The Finite Supply

Bitcoin has a finite supply, and only 21 million Bitcoin coins can ever come into existence, with 19 million already in circulation. This scarcity boosts its long-term value. On reaching the predetermined cap, demand will outpace supply.

Bitcoin’s enduring value, utility, and potential for continued growth protect it from bubble vulnerabilities. Here at ai-stakes.com, our AI-powered machine-learning algorithm automatically trades Bitcoin, and a broad selection of other cryptocurrencies. It also buys and sells a variety of additional financial assets, including stocks, bonds, forex, indices, and commodities. Learning on the job, from each trade it executes on clients’ behalf, AiStakes works 24 hours a day, generating profits from trading and managing risk with ever greater efficiency.

For a better understanding of all types of financial assets as well as various trading-related subjects, from effective market strategies to the latest trading technologies, browse the AiStakes blog.